Focus on Scalp Health and Wellness

There is a growing awareness of the importance of scalp health within the hair care market in Japan. Consumers are increasingly recognizing that a healthy scalp is essential for maintaining vibrant hair, leading to a rise in products specifically designed for scalp care. This trend is reflected in the introduction of specialized shampoos, exfoliants, and treatments that target scalp issues such as dryness and irritation. The hair care market is responding by expanding its product lines to include scalp-focused solutions, which are projected to grow by approximately 10% annually as consumers prioritize holistic hair care.

Growing Demand for Premium Products

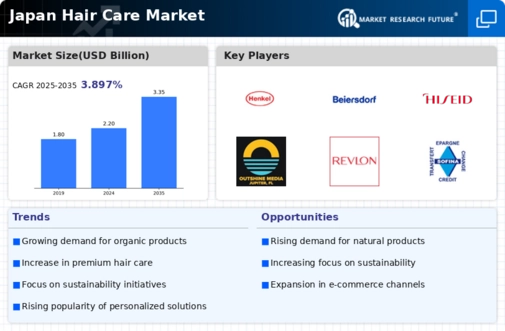

The hair care market in Japan is experiencing a notable shift towards premium products, driven by consumers' increasing willingness to invest in high-quality hair care solutions. This trend is reflected in the rising sales of luxury shampoos, conditioners, and treatments, which have seen growth rates of approximately 15% annually. As Japanese consumers become more discerning, they seek products that not only enhance hair health but also offer unique benefits such as anti-aging properties and advanced formulations. The hair care market is thus adapting to this demand by introducing innovative products that cater to the sophisticated preferences of consumers, further solidifying the premium segment's position in the market.

Aging Population and Hair Care Needs

Japan's aging population is significantly influencing the hair care market, as older consumers seek products tailored to their specific needs. With approximately 28% of the population aged 65 and older, there is a growing demand for hair care solutions that address issues such as thinning hair and scalp health. Brands are responding by developing specialized products that cater to this demographic, including treatments that promote hair growth and enhance scalp vitality. The hair care market is thus expanding its offerings to include formulations that appeal to older consumers, recognizing the potential for growth in this segment.

Rise of E-commerce and Online Shopping

The hair care market in Japan is witnessing a substantial shift towards e-commerce, as consumers increasingly prefer the convenience of online shopping. Recent data indicates that online sales of hair care products have surged by over 30% in the past year, driven by the pandemic's long-lasting effects on shopping habits. E-commerce platforms provide consumers with access to a wider range of products, often at competitive prices, which is reshaping the retail landscape. The hair care market is adapting by enhancing its online presence and investing in digital marketing strategies to capture this growing segment of tech-savvy consumers.

Influence of Social Media and Beauty Trends

Social media platforms play a pivotal role in shaping consumer preferences within the hair care market in Japan. Influencers and beauty bloggers frequently showcase new products and techniques, creating a buzz that drives sales. The impact of visual platforms like Instagram and TikTok is particularly pronounced, with many consumers turning to these channels for inspiration and recommendations. This trend has led to a surge in the popularity of specific hair care products, with some brands reporting increases in sales by over 20% following viral promotions. The hair care market must continuously adapt to these rapidly changing trends to remain relevant and competitive.