Major market players are spending a lot of money on R&D to increase their product lines, which will help the Polypropylene Market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Polypropylene industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

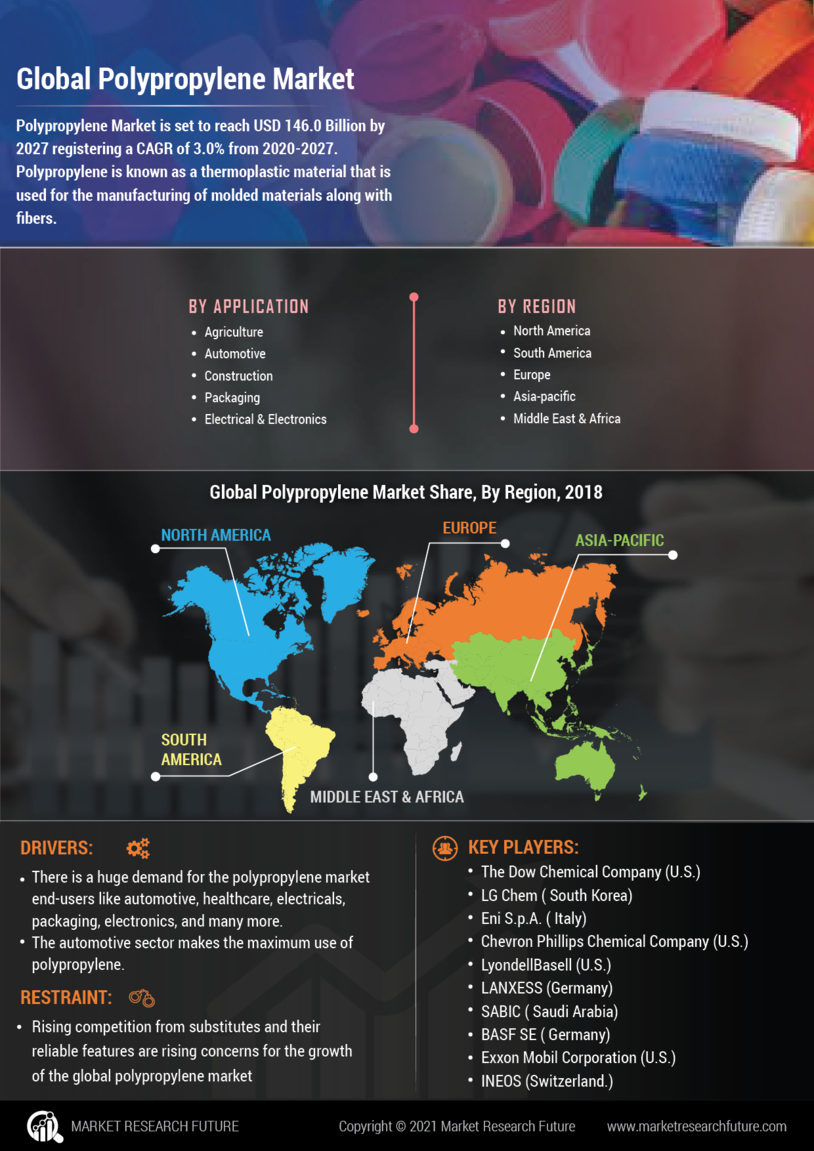

One of the primary business strategies adopted by manufacturers in the polypropylene industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, the polypropylene industry has provided materials with some of the most significant benefits. The polypropylene markets major player such as SABIC (Saudi Arab), LG Chem (South Korea), BASF SE(Germany), and many others.

India's top oil and gas corporation, Bharat Petroleum Corporation Ltd (BPCL), announced on Wednesday that a polypropylene unit project at its Kochi refinery in Kerala has been approved for implementation in 2023. In order to fulfill the nation's growing need for petrochemicals, the business announced that its board of directors had approved an investment of ₹5,044 crore to establish a polypropylene production facility at its refinery in Kochi.

The Comprehensive Economic Partnership Agreement (CEPA), a proposed free-trade agreement (FTA) between Oman and India, may encounter difficulties in 2024 as a result of requests for customs duty exemptions on petrochemical products like polypropylene and polyethylene. Opponents of the tariff concessions are certain domestic players who point to Oman's substantial subsidies on raw materials used in petrochemical production.

According to an official, the demand for customs tax concessions on petrochemical items, mostly used in the plastics industry, such polypropylene and polyethylene, could be a sticking point in the early stages of negotiations for the planned free-trade agreement (FTA) between India and Oman. The Comprehensive Economic Partnership Agreement (CEPA) negotiations are currently in their final stages.

SABIC (Saudi Arab) is a Saudi manufacturing firm for chemicals. Saudi Aramco is the owner of 70% of SABIC's shares. Petrochemicals, chemicals, industrial polymers, fertilisers, and metals are among its active applications. According to its Tadawul listing, it is the second-largest public business in the Middle East and Saudi Arabia. SABIC was ranked fourth ly among chemical firms by Fortune 500. SABIC ranked as the 281st-largest corporation in the world by the year's conclusion.

In April 2021, SABIC, a leader in the chemical industry, announced that Beiersdorf will innovate the packaging of its world-leading ‘NIVEA Naturally Good’ range of face creams using SABIC’s certified renewable polymers. SABIC’s bio-based polypropylene (PP) resin, part of its TRUCIRCLE™ portfolio, will be used for producing the jars of Beiersdorf’s NIVEA Naturally Good day and night face creams. The new product is playing into Beiersdorf’s ambitious Sustainable Packaging Targets 2025 to reduce fossil-based, virgin plastic for its cosmetic packaging products by 50 percent.

A worldwide chemical corporation with offices in London, the UK and Houston, Texas, LyondellBasell Industries N.V. was founded in the Netherlands. In terms of polyethylene and polypropylene technologies, the firm is the largest licensee. Additionally, it makes oxyfuels, polyolefins, ethylene, and propylene.

In December Lyondell Basell introduced Beon3D, a cutting-edge PP product line that will offer a distinctive design and enable the production of intricate, high-quality 3D-printed objects in a single step. This product was created by fusing additive manufacturing and polymer technologies.

The transportation, industrial, building & construction, and consumer goods sectors will all benefit from this product line.