Growth in Construction Activities

The construction industry is witnessing a resurgence, leading to an increased demand for polyurethane processing machines. Polyurethane materials are favored for their insulation properties, durability, and versatility in applications such as flooring, roofing, and wall systems. The polyurethane processing machine market is poised to capitalize on this growth, as construction projects increasingly incorporate polyurethane solutions to enhance energy efficiency and sustainability. In 2025, the construction sector is anticipated to contribute significantly to the market, with a projected growth rate of approximately 6% per year. This trend suggests that manufacturers of polyurethane processing machines will need to adapt their offerings to meet the evolving needs of the construction industry.

Increasing Focus on Sustainability

Sustainability is becoming a central theme in various industries, including the polyurethane processing machine market. Manufacturers are increasingly adopting eco-friendly practices and materials, driven by regulatory pressures and consumer preferences for sustainable products. The demand for bio-based polyurethanes and recycling technologies is on the rise, prompting machine manufacturers to innovate and develop processing solutions that align with these sustainability goals. By 2025, the market for sustainable polyurethane processing machines is expected to grow at a rate of around 5%, indicating a shift towards greener manufacturing practices. This trend may encourage collaboration between material suppliers and machinery manufacturers to create more sustainable production processes.

Rising Demand in Automotive Sector

The automotive sector is experiencing a notable increase in demand for polyurethane processing machines, driven by the need for lightweight and durable materials. Polyurethane is increasingly utilized in vehicle interiors, seating, and insulation, which enhances comfort and energy efficiency. The polyurethane processing machine market is projected to benefit from this trend, as manufacturers seek advanced machinery to meet the growing requirements for high-performance components. In 2025, the automotive industry is expected to account for a significant share of the polyurethane processing machine market, with an estimated growth rate of around 5% annually. This demand is likely to spur innovation in processing technologies, enabling manufacturers to produce more complex and customized parts efficiently.

Technological Innovations in Machinery

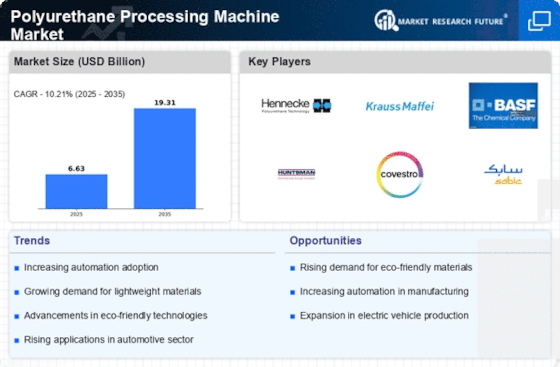

Technological advancements in polyurethane processing machines are driving the market forward. Innovations such as automation, precision control, and enhanced efficiency are becoming increasingly prevalent. These advancements allow manufacturers to produce polyurethane products with greater accuracy and reduced waste, which is essential in a competitive market. The polyurethane processing machine market is likely to see a surge in demand for machines equipped with smart technologies, enabling real-time monitoring and adjustments during production. As of 2025, it is estimated that the market for technologically advanced processing machines will grow by approximately 7%, reflecting the industry's shift towards more sophisticated manufacturing processes.

Customization and Versatility in Applications

The need for customization in various applications is a significant driver for the polyurethane processing machine market. Industries such as furniture, footwear, and packaging are increasingly seeking tailored solutions to meet specific requirements. Polyurethane processing machines that offer flexibility and adaptability in production processes are in high demand. This trend is likely to continue, with manufacturers focusing on developing machines that can handle a wide range of formulations and product designs. In 2025, the market for customizable polyurethane processing machines is projected to grow by approximately 6%, reflecting the industry's response to the diverse needs of end-users across multiple sectors.