Market Trends

Key Emerging Trends in the Preimplantation Genetic Testing Market

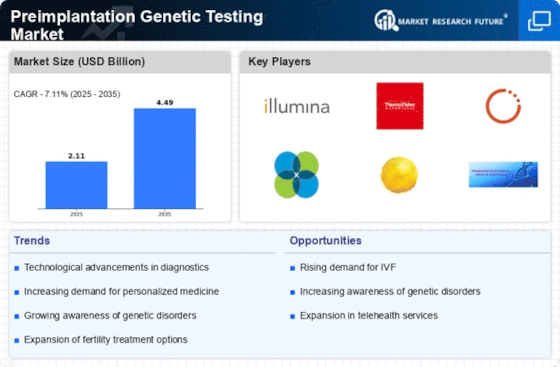

The Preimplantation Genetic Testing (PGT) Market has grown due to reproductive technology advances, genetic disease awareness, and need for individualized and precision reproductive treatment. PGT is being used for chromosomal analysis and genetic testing for hereditary disorders, in addition to aneuploidy screening. Prospective parents may now analyze a wider spectrum of genetic defects in embryos, providing a more complete genetic profile before implantation.

Demand for non-invasive PGT procedures such blastocyst culture and trophectoderm biopsy is rising. These methods capture genetic material without hurting the embryo, making assisted reproductive treatments safer and less intrusive. This trend fits with the focus on reducing embryo hazards and enhancing PGT safety.

Next-generation sequencing (NGS) is also being integrated into PGT. NGS can detect more genetic disorders with better precision due to its improved resolution and accuracy. This trend shows how genetic testing platforms are improving, making preimplantation screening more reliable and sensitive.

PGT for elective single embryo transfer (eSET) in assisted reproductive cycles is growing. With powerful bioinformatics tools and AI algorithms for data analysis, PGT technology is altering the industry. These techniques improve genetic data interpretation, making embryo selection for implantation more reliable. AI integration shows a dedication to using technology to improve PGT dependability and efficiency.

The market is also affected by younger people's fertility preservation and testing trends. Many people postpone childbearing, increasing need for fertility preservation and genetic testing before assisted reproductive therapies. This proactive family planning concept lets people use their genetic profile to choose reproductive alternatives.

Genetic testing labs, reproductive clinics, and healthcare practitioners are working together to improve PGT technology and make it more accessible. Research, development, and standardization collaborations increase PGT services. This collaborative movement emphasizes the need for multidisciplinary reproductive care.

The market is also paying more attention to PGT ethics and regulations. PGT usage requires clear norms and ethical standards to ensure responsible and informed decision-making by healthcare practitioners and prospective parents as technology improves. This development shows the dedication to ethical genetic testing in reproductive care.

Leave a Comment