Research Methodology on Quantum Cryptography Market

1. Introduction:

This research study aims to identify the market trends and opportunities in the quantum cryptography market and forecast the market growth of the same from 2023 to 2030. Extensive primary and secondary research has been conducted to compile the data and insights featured in this report. The market data and insights sourced from industry experts and stakeholders have been analyzed to develop the market size, market forecast, and market share.

2. Research Methodology:

A comprehensive research methodology has been developed and followed to undertake the market analysis of the quantum cryptography market. This research methodology includes extracting information through primary and secondary research, conducting qualitative and quantitative analysis of the market data, developing market sizing, and forecasting the market growth of the quantum cryptography market.

2.1. Need for Research:

Quantum cryptography is witnessing significant growth and is expected to grow exponentially in the coming years due to its increasing demand across various end-user industries. This study will help the readers to understand the quantum cryptography market by analysing market dynamics, value chain structure, market segmentation and regional analyses.

2.2Research Design:

For this market analysis, a bottom-up approach has been taken to provide an unbiased market forecast. Market size estimations are based on the factors influencing the growth of the quantum cryptography market. The bottom-up approach was used to derive the global market size of the quantum cryptography market from the revenue of key players operating in the market. Market share analysis has been used to identify the regional market share of players.

2.3 Research Scope:

The scope of this study encompasses qualitative and quantitative analyses of the quantum cryptography market. This study also provides detailed insights into the market segmentation, technology, application, and regional outlook of the quantum cryptography market.

2.4 Source of Information:

The primary and secondary sources involved in this study include the market players, stakeholders, industry experts, industry databases, company reports, and annual reports. Primary and secondary research has been conducted to extract market data and insights into the quantum cryptography market.

The market data has been collected from industry experts, and the market numbers have been verified and validated by senior industry analysts. Primary and secondary research insights into the quantum cryptography market have been further analysed using various statistical methods and techniques to develop detailed market forecasts and estimates.

3. Market Segmentation:

The market has been segmented based on component, type, end user, and geography. The component segment of the market includes hardware, software, and services. On the basis of type, the market is split into single-photon detectors, photon sources, cryptography, and others. The end user segment includes government and defence, banking and finance, healthcare, IT and telecom, and academia and research.

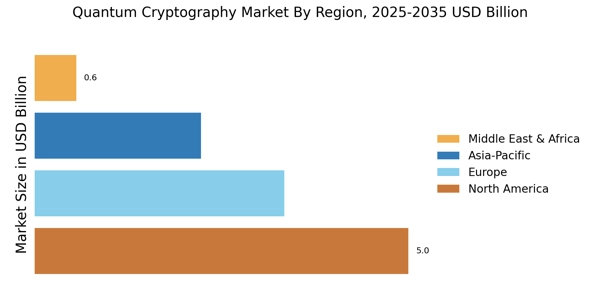

The market is segmented into four regions; North America, Europe, Asia-Pacific, and Rest-of-the-World. Each of these regions has been further segmented into countries to provide a comprehensive regional market size and analysis.

4. Market Estimation:

The market sizes have been estimated using triangulation and bottom-up approaches. The market sizes from various sources have been further validated using primary research. The market sizes have been estimated using market trends, historical data, and macroeconomic factors. The forecast period used for the market analysis is 2023 to 2030.

4.1 Assumptions:

The market sizes have been based on the market dynamics, manufacturers’ shipments, sales, and pricing data. The assumptions on which the market size has been based are:

1) Rise of demand for quantum cryptography from various end-user industries

2) Growing acceptance in government and defence application

3) Increased demand from the banking and finance sector

4) Increase in research and development activities

5. Data Triangulation:

The data triangulation process was used to validate the market estimates and sizes using various sources of data. The data triangulation process included market sizes of different sources, such as the market size of industry experts, data obtained from primary and secondary sources, and views of stakeholders. The market size estimation and validation were done using market trends, company reports, industry databases, and third-party validation.