Government Initiatives and Funding

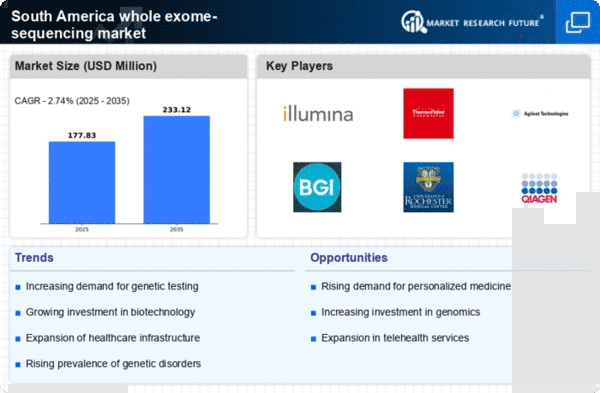

Government initiatives aimed at promoting genetic research and healthcare innovation are significantly influencing the whole exome-sequencing market. In South America, various governments are allocating funds to support genomic research and the development of advanced diagnostic technologies. For instance, public health programs are increasingly incorporating genetic testing as part of preventive healthcare strategies. This financial backing not only facilitates the establishment of state-of-the-art laboratories but also encourages collaborations between academic institutions and private companies. As a result, the market is expected to witness a surge in the availability of whole exome sequencing services, potentially leading to a market growth rate of over 15% annually in the coming years.

Rising Investment in Genomic Research

The increasing investment in genomic research is a vital driver for the whole exome-sequencing market. In South America, both public and private sectors are recognizing the importance of genomics in advancing healthcare solutions. Funding for research initiatives focused on genetic diseases is on the rise, leading to the establishment of specialized research centers and collaborations with international organizations. This influx of investment is likely to enhance the capabilities of local laboratories, enabling them to offer advanced whole exome sequencing services. Furthermore, as research progresses, the potential for discovering new genetic markers and therapeutic targets may further stimulate market growth, with estimates suggesting a compound annual growth rate (CAGR) of approximately 18% in the coming years.

Growing Awareness of Personalized Medicine

The shift towards personalized medicine is becoming a pivotal factor in the whole exome-sequencing market. As healthcare professionals and patients recognize the benefits of tailored treatment plans based on genetic information, the demand for whole exome sequencing is likely to rise. This approach allows for more effective therapies and improved patient outcomes, which is particularly relevant in oncology and rare disease management. In South America, the increasing focus on personalized healthcare solutions is prompting healthcare providers to adopt whole exome sequencing as a standard practice. Consequently, this trend may lead to a substantial increase in market penetration, with projections suggesting a potential market value exceeding $500 million by 2027.

Increasing Prevalence of Genetic Disorders

The rising incidence of genetic disorders in South America is a crucial driver for the whole exome-sequencing market. As healthcare providers and patients become more aware of genetic conditions, the demand for comprehensive genetic testing is likely to increase. Reports indicate that approximately 1 in 300 individuals may be affected by a rare genetic disorder, which underscores the necessity for advanced diagnostic tools. This growing awareness is prompting healthcare systems to integrate whole exome sequencing into routine clinical practice, thereby expanding its market reach. Furthermore, the potential for early diagnosis and personalized treatment plans is driving investments in genetic research and testing facilities, which could enhance the overall landscape of the whole exome-sequencing market in the region.

Technological Advancements in Sequencing Techniques

Technological innovations in sequencing methodologies are driving the evolution of the whole exome-sequencing market. The introduction of next-generation sequencing (NGS) technologies has significantly reduced the cost and time required for whole exome sequencing, making it more accessible to healthcare providers in South America. Enhanced accuracy and efficiency of these technologies are likely to attract more clinical laboratories to offer whole exome sequencing services. Moreover, the development of user-friendly bioinformatics tools is facilitating data analysis, which is essential for interpreting complex genetic information. As a result, the market is expected to expand rapidly, with an anticipated growth rate of around 20% over the next few years.