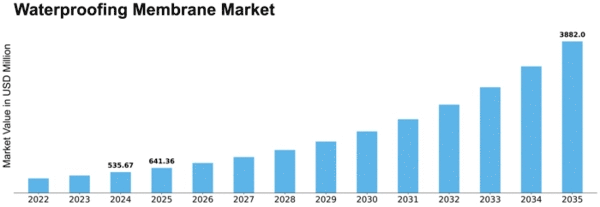

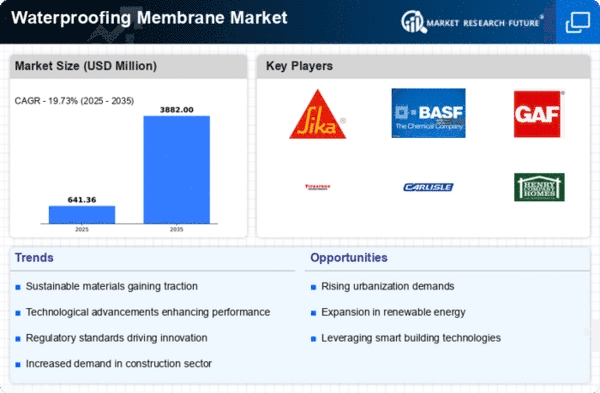

Waterproofing Membrane Size

Waterproofing Membrane Market Growth Projections and Opportunities

The application segmentation of the global liquid roofing market includes residential, commercial, industrial, and public infrastructure. Among these, the commercial segment holds a significant share, driven by the surging demand for efficient roofing solutions in commercial buildings. The industrial segment is also witnessing substantial growth, attributed to the need for durable and weather-resistant roofing systems in various industrial facilities. Moreover, the increasing investments in infrastructure development projects globally are fueling the demand for liquid roofing systems in public infrastructure.

Geographically, North America dominates the global liquid roofing market due to a robust construction industry and increasing renovation and remodeling activities. The region's focus on sustainable construction practices and the adoption of eco-friendly roofing materials contribute significantly to the market's growth. Meanwhile, the Asia-Pacific region is projected to witness remarkable growth in the liquid roofing market during the forecast period. Rapid urbanization, industrialization, and government initiatives to promote infrastructure development are key factors driving market expansion in this region.

Innovation and product development strategies are crucial for companies operating in the liquid roofing market to maintain a competitive edge. Market players are consistently focusing on technological advancements to introduce high-performance, cost-effective, and environmentally friendly liquid roofing solutions. Additionally, strategic collaborations, mergers, and acquisitions are prominent strategies adopted by key market players to strengthen their market presence and expand their product portfolios.

The global liquid roofing market is anticipated to witness steady growth, supported by increasing construction activities across various sectors and a rising emphasis on sustainable roofing solutions. The market's evolution is expected to be influenced by ongoing technological advancements, the introduction of innovative materials, and the adoption of stringent environmental regulations promoting eco-friendly roofing systems. As the market continues to evolve, it offers lucrative opportunities for manufacturers, contractors, and other stakeholders to capitalize on the growing demand for liquid roofing systems worldwide.

Leave a Comment