Research Methodology on Antibody-Drug Conjugate Market

1 Introduction

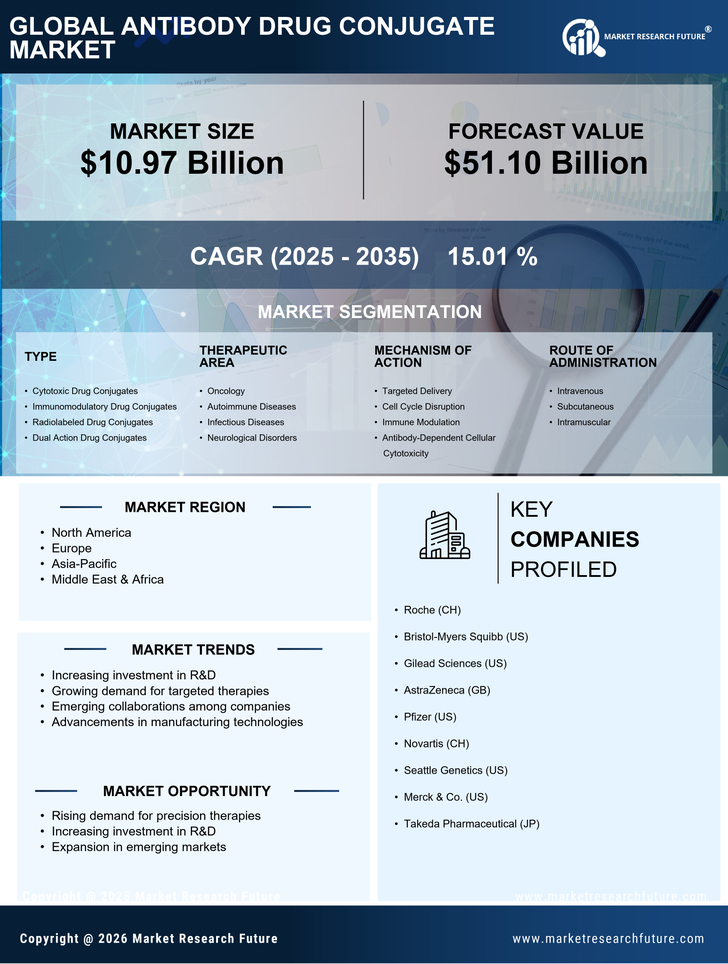

Antibody-Drug Conjugate (ADCs) offer the potential to increase drug potency and target selectivity for the successful treatment of a variety of diseases including cancer. The growing incidence of cancer, increasing R&D investments associated with ADCs, and the growing availability of patient centres of excellence are expected to drive the growth of the global ADC market. The Antibody Drug Conjugates (ADCs) Market research report provides an in-depth analysis of the global Antibody Drug Conjugates (ADCs) market with an emphasis on the emerging trends, market size, and share, key drivers and restraints, Porter’s Five Forces Analysis, competitive landscape, and technological dynamics. It provides comprehensive information on the latest developments in the global Antibody Drug Conjugates (ADCs) market during 2023-2030.

2 Research Methodology

2.1 Research Design

The market research process involved in this Antibody Drug Conjugates (ADC) market research study uses a mix of qualitative and quantitative techniques. The data collection stage of the research uses primary and secondary sources such as industry experts, market analysts, and publicly available documents. In order to collect and assess the data gathered, a variety of research methods such as critical-looking analysis, bibliographic analysis, and expert interviews are used. The research also includes in-depth market opportunity analysis and value chain analysis to identify the sources of revenue growth. Furthermore, Porter’s Five Forces Analysis and SWOT Analysis are used to analyze the macro and micro environment in which the Antibody Drug Conjugates (ADCs) market operates.

2.2 Data Collection Methods

The research study uses a variety of data collection methods including secondary sources, primary research, and expert interviews. Secondary data sources include books, industry journals, trade magazines, and web content. Primary research is done by conducting interviews with industry experts and market analysts. Additionally, publicly available documents such as White Papers and press releases have been included in the research.

2.3 Research Process

The research process follows a structured and logical approach to gathering data and generating insights. The market research started with an initial review and analysis of the primary and secondary sources. This is followed by a detailed market overview, Opportunity Analysis, and SWOT analysis. The research also includes an in-depth market segmentation analysis to understand the key drivers and trends in the Antibody Drug Conjugates (ADCs) market. The analysis process includes the identification of key drivers and restraints and the analysis of their relative market impacts. The analysis provided insight into the potential revenue growth scenarios of the Antibody Drug Conjugates (ADCs) market.

2.4 Data Analysis

Data analysis is conducted to get a better understanding of the Antibody Drug Conjugates (ADCs) market in terms of key trends, drivers, and restraints. The analysis process includes the identification of the key drivers and restraints and the analysis of their relative market impacts. Subsequently, the revenue opportunity analysis is conducted to understand the potential growth in the Antibody Drug Conjugates (ADCs) market. The research study also includes an in-depth market segmentation analysis to understand the key geographical regions, end-use industries, and applications for the Antibody Drug Conjugates (ADCs) market.

2.5 Ethical Considerations

The research study is conducted with due consideration of ethical standards. The sources of data used are a fully transparent and fair representation of the market. The sources are not biased in any way and the information provided is verifiable. Additionally, the opinion of the industry experts has gathered anonymously and based on their knowledge of the market.

3 Research Objectives

The main objective of the market research study is to understand the key drivers and restraints associated with the growth of the global Antibody Drug Conjugates (ADCs) market. Specific objectives of the research included:

- To understand the market size and growth rate of the global Antibody Drug Conjugates (ADCs) market.

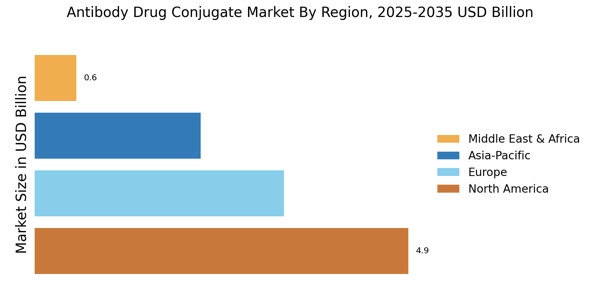

- To analyze the key markets in terms of geography, end-use industries, and applications and their growth potential.

- To identify the key drivers and restraints impacting the growth of the Antibody Drug Conjugates (ADCs) market.

- To analyze the market opportunity and the potential growth scenarios for the Antibody Drug Conjugates (ADCs) market.

4 Research Scope

The research study covers the Antibody Drug Conjugates (ADCs) market with a special emphasis on the key markets in terms of geography, end-use, and applications. The research also includes an in-depth analysis of the key drivers, restraints, opportunities, and challenges impacting the market. Furthermore, the research study also covers market segmentation, market opportunity analysis, and Porter’s Five Forces Analysis to understand the micro and macro environment in which the market operates.

5 Conclusion

The market research study provides an in-depth analysis of the Antibody Drug Conjugates (ADCs) market with an emphasis on the key markets in terms of geography, end-use, and applications. The Antibody Drug Conjugates (ADCs) Market research report provides comprehensive information on the latest developments in the global Antibody Drug Conjugates (ADCs) market during 2023-2030. The research study uses a mix of qualitative and quantitative techniques to analyze the market opportunity and potential scenarios for the market. The research also includes an in-depth market segmentation analysis to identify the key drivers and trends in the Antibody Drug Conjugates (ADCs) market. The report also includes a detailed market opportunity analysis to understand the potential for growth in the Antibody Drug Conjugates (ADCs) market.