Cloud Services Brokerage Market Summary

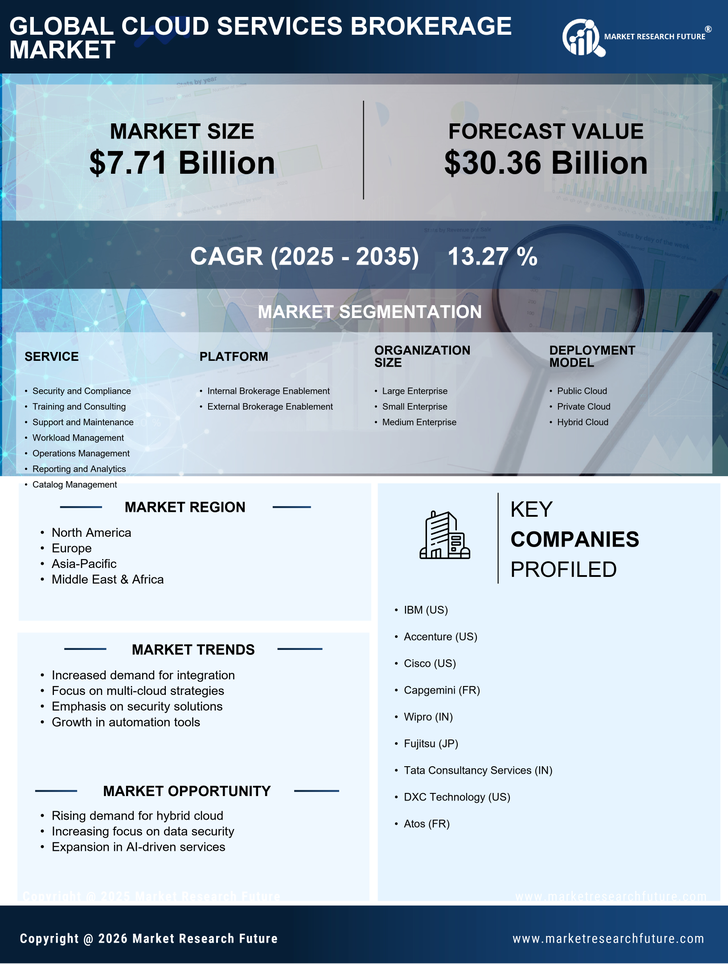

As per Market Research Future analysis, the Cloud Services Brokerage Market Size was estimated at 7.71 USD Billion in 2024. The Cloud Services Brokerage industry is projected to grow from 8.733 USD Billion in 2025 to 30.36 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 13.27% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Cloud Services Brokerage Market is experiencing robust growth driven by multi-cloud strategies and heightened security concerns.

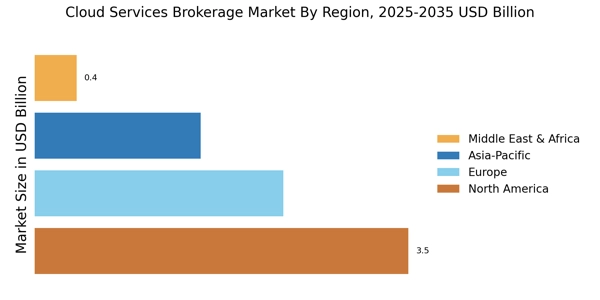

- The integration of multi-cloud strategies is becoming increasingly prevalent in North America, the largest market for cloud services.

- In Asia-Pacific, the focus on security and compliance is driving rapid growth in the cloud services brokerage sector.

- Automation in cloud management is gaining traction, particularly within the fastest-growing training and consulting segment.

- The increased demand for cloud services and the emphasis on cost optimization are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 7.71 (USD Billion) |

| 2035 Market Size | 30.36 (USD Billion) |

| CAGR (2025 - 2035) | 13.27% |

Major Players

IBM (US), Accenture (US), Cisco (US), Capgemini (FR), Wipro (IN), Fujitsu (JP), Tata Consultancy Services (IN), DXC Technology (US), Atos (FR)