Research Methodology on Environmental Monitoring Market

1. Introduction

The research methodology aims to provide insights into the environmental monitoring market. Specifically, the methodology provides the following areas of focus:

-Design of the study

-Data sources and methodology

-Market size estimation

-List of secondary sources

-Market breakdown and data triangulation

-Assumptions

The research methodology is designed to provide an in-depth understanding of the global environmental monitoring market. The research methodology comprises both primary and secondary sources of data collection. Primary sources of data included interviews with industry experts and surveys among end-user industries. These methods aim to collect real-time perspectives of key stakeholders in the market. The data gathered was combined with data collected through secondary sources including market databases, published papers and reports from industry associations, such as the World Meteorological Organization (WMO), the European Centre for Medium-Range Weather Forecasts (ECMWF), the Global Biodiversity Information Facility (GBIF) and publications from other organizations.

2. Design of the Study

The research is based on the bottom-up approach. Primary sources of data collection were interviews with a selected number of key people from the environmental monitoring industry. The interviewees included industry experts, market analysts and other related experts. The techniques used for the interviews included direct and heated interviews, personal interviews, and telephone and/or face-to-face interviews.

The surveys conducted were both online and offline and incorporated questions that delved into the opinions, thoughts and opinions of the end-user industries. The questions aimed to obtain an understanding of the current market situation, the prevailing strategies adopted by the leading players, the emerging trends and future possibilities.

The insights collected from primary and secondary sources were used to estimate the market size. This is based on a top-down approach, wherein market shares of the leading players in the market, market penetration rates and the projected growth rates of the global market were analyzed.

3. Sources of Data and Methodology

The data for this research study is collected from both primary and secondary sources. Primary sources included interviews and surveys conducted with industry experts and market analysts, as well as interviews with end-user industries.

The data gathered from secondary sources such as published papers from government and industry associations, and listings from market databases, among others, were used to cross-check and supplement the data from the primary sources. The data from both the primary and secondary sources were analyzed, compared and triangulated to arrive at an accurate market figure.

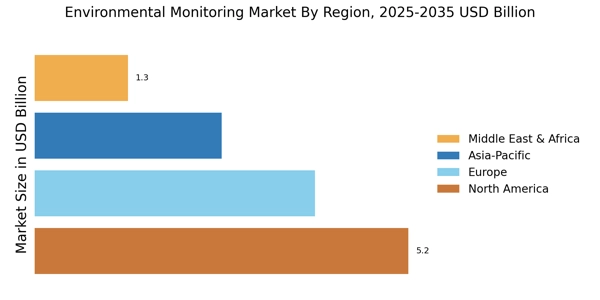

4. Market Size Estimation

Market size estimation for the global environmental monitoring market is based on a combination of top-down and bottom-up approaches. The top-down approach entails analyzing the market sizes of the major players in the market and estimating the global market size accordingly. The bottom-up approach involves analyzing the data collected from primary sources to have an estimate of the market size. The market size estimation is based on the calculated yearly growth rate and market penetration rate and projected growth rate in the forecast period from 2023 to 2030.

5. Market Breakdown and Data Triangulation

In order to assess the market size, market shares of the leading players, as well as the market penetration rates and rates of growth for the global environmental monitoring market were analyzed. The data collected from primary sources was further augmented by the data from secondary sources. The data from primary and secondary sources were compared, analyzed and triangulated to arrive at an accurate estimate of the global market figure.