Advancements in Bioinformatics Tools

The metagenomic sequencing market is significantly impacted by advancements in bioinformatics tools that facilitate data analysis and interpretation. As sequencing technologies generate vast amounts of data, the need for sophisticated analytical tools becomes paramount. Enhanced bioinformatics capabilities enable researchers to process and analyze complex metagenomic datasets more efficiently, leading to more accurate insights into microbial communities. In the US, the bioinformatics market is expected to grow to approximately $10 billion by 2025, driven by the increasing demand for data-driven decision-making in various sectors, including healthcare and environmental science. This driver underscores the importance of integrating advanced bioinformatics solutions into the metagenomic sequencing market, as they enhance the overall utility and applicability of sequencing data.

Rising Demand for Personalized Medicine

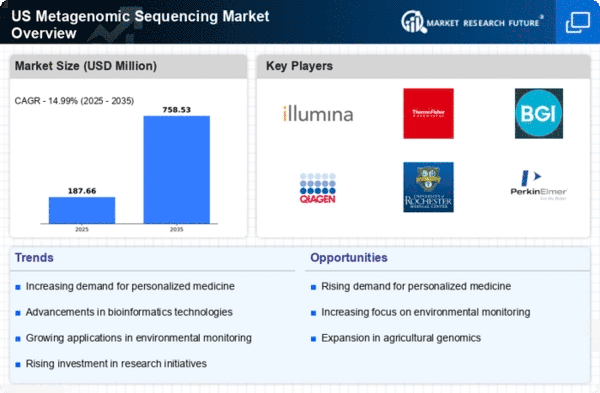

The metagenomic sequencing market is experiencing a notable surge in demand for personalized medicine. As healthcare shifts towards tailored treatments, the ability to analyze individual microbiomes becomes crucial. This trend is driven by advancements in sequencing technologies that allow for more precise and comprehensive analysis of microbial communities. In the US, the market for personalized medicine is projected to reach approximately $350 billion by 2025, indicating a robust growth trajectory. The integration of metagenomic sequencing into clinical practices enhances the understanding of patient-specific responses to therapies, thereby improving treatment outcomes. Consequently, this driver is pivotal in shaping the metagenomic sequencing market, as healthcare providers increasingly rely on detailed microbial insights to inform their clinical decisions.

Growing Interest in Environmental Monitoring

The metagenomic sequencing market is witnessing a growing interest in environmental monitoring, particularly in assessing microbial diversity and ecosystem health. As environmental concerns escalate, there is an increasing emphasis on understanding the role of microorganisms in various ecosystems. Metagenomic sequencing provides a powerful tool for monitoring microbial communities in soil, water, and air, enabling researchers to track changes in biodiversity and detect pollutants. In the US, the environmental monitoring market is projected to reach $20 billion by 2026, with a significant portion attributed to microbial analysis. This driver highlights the potential of metagenomic sequencing to contribute to environmental sustainability efforts, as stakeholders seek to leverage microbial insights for better management of natural resources.

Increased Collaboration Between Academia and Industry

The metagenomic sequencing market is benefiting from increased collaboration between academia and industry, fostering innovation and accelerating research. Partnerships between academic institutions and biotechnology companies are becoming more common, as they seek to leverage each other's strengths in research and development. This collaboration is particularly evident in the development of novel sequencing technologies and applications. In the US, funding for academic-industry partnerships has seen a rise, with federal grants supporting collaborative projects aimed at advancing metagenomic research. This driver is likely to enhance the metagenomic sequencing market by facilitating the translation of research findings into practical applications, ultimately leading to improved products and services in the field.

Expansion of Applications in Infectious Disease Research

The metagenomic sequencing market is significantly influenced by the expansion of applications in infectious disease research. With the increasing prevalence of antibiotic-resistant pathogens, there is a pressing need for innovative diagnostic tools. Metagenomic sequencing offers a comprehensive approach to identify and characterize pathogens directly from clinical samples, facilitating timely and accurate diagnoses. In the US, the market for infectious disease diagnostics is expected to grow at a CAGR of around 8% through 2025. This growth is likely to be fueled by the rising incidence of infectious diseases and the need for rapid identification methods. As researchers and clinicians adopt metagenomic sequencing for its ability to provide insights into complex microbial communities, this driver is expected to play a crucial role in the market's evolution.