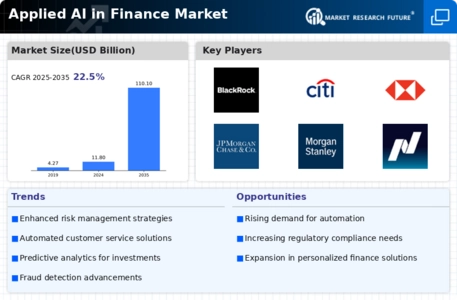

Based on Region, the global Applied AI in Finance is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Further, the major countries studied in the market report are the U.S., Canada, Germany, UK, Italy, Spain, China, Japan, India, Australia, UAE, and Brazil.

North America dominated the applied artificial intelligence in Finance market in 2022, this dominance can be attributed to several key factors. Firstly, North America has a well-developed financial sector which consists of numerous banks, insurance companies, and investment firms. These institutions are increasingly adopting AI technologies to streamline their operations, improve customer experience, and enhance decision-making processes. Additionally, North America has a thriving ecosystem for AI innovation, with a multitude of tech startups and established companies focusing on AI solutions in the finance industry.

Investments in AI research and development, along with favorable government policies and initiatives, have further facilitated market growth in the region. Another contributing factor is the availability of a skilled workforce. North America is home to leading universities and research institutions that offer specialized programs in both AI and finance, ensuring a consistent supply of qualified professionals in this field. Furthermore, the region benefits from a strong technological infrastructure, including advanced computing capabilities and high-speed internet connectivity, which allows for seamless integration and implementation of AI solutions in financial institutions.

Given these factors, it is anticipated that North America will continue to dominate the applied AI in finance market, capturing the largest market share in 2022.

There is significant growth occurring in the Asia-Pacific region regarding the adoption and use of artificial intelligence (AI) in the finance industry. AI is increasingly being utilized to enhance efficiency, accuracy, and decision-making across various financial services, including banking, insurance, investment management, and risk assessment. Within the banking sector, AI is transforming customer service through the use of chatbots and virtual assistants, which provide personalized and real-time assistance, improving the overall banking experience. Through the analysis of large volumes of data, AI algorithms can rapidly evaluate creditworthiness, identify fraudulent activities, and generate precise credit scores.

This not only streamlines loan approval processes but also decreases the risk of credit defaults. Similarly, AI is revolutionizing investment management by employing advanced machine learning techniques to analyze historical data and recognize patterns, trends, and correlations in the financial markets. By leveraging AI algorithms, asset managers can make informed investment choices, optimize portfolios, and develop more effective strategies. This not only improves investment performance but also mitigates the negative impact of human biases and emotions on decision-making. Additionally, AI greatly benefits the insurance industry, with insurers utilizing it to automate claim processing for faster and more accurate settlements.

AI-powered chatbots handle customer queries and assist with policy purchases and renewals, enhancing customer experience. Moreover, AI algorithms can analyze vast amounts of data to identify potential risks, enabling insurers to better assess premiums and create customized policies. This improves risk assessment and underwriting processes, leading to more efficient and cost-effective insurance operations. The application of AI in finance extends beyond traditional banking and insurance sectors, as fintech startups in the Asia-Pacific region heavily invest in AI technologies to disrupt the financial services industry. These startups develop innovative solutions, including robo-advisors, alternative lending platforms, and blockchain-based payment systems.

By leveraging AI algorithms, these startups offer personalized financial advice, automate lending processes, and enhance the security and efficiency of financial transactions.

FIGURE 3: APPLIED AI IN FINANCE MARKET SIZE BY REGION 2022 VS 2032, (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review