Regulatory Developments

The Global counter uas Industry is influenced by evolving regulatory frameworks aimed at managing drone operations. Governments worldwide are implementing stricter regulations to govern the use of drones, particularly in sensitive areas such as airports, military installations, and public events. These regulations often necessitate the deployment of counter-drone systems to ensure compliance and safety. For instance, the Federal Aviation Administration in the United States has introduced guidelines that mandate the use of countermeasures in specific scenarios. As regulatory pressures increase, organizations are likely to invest in counter UAS technologies, further driving market growth and innovation.

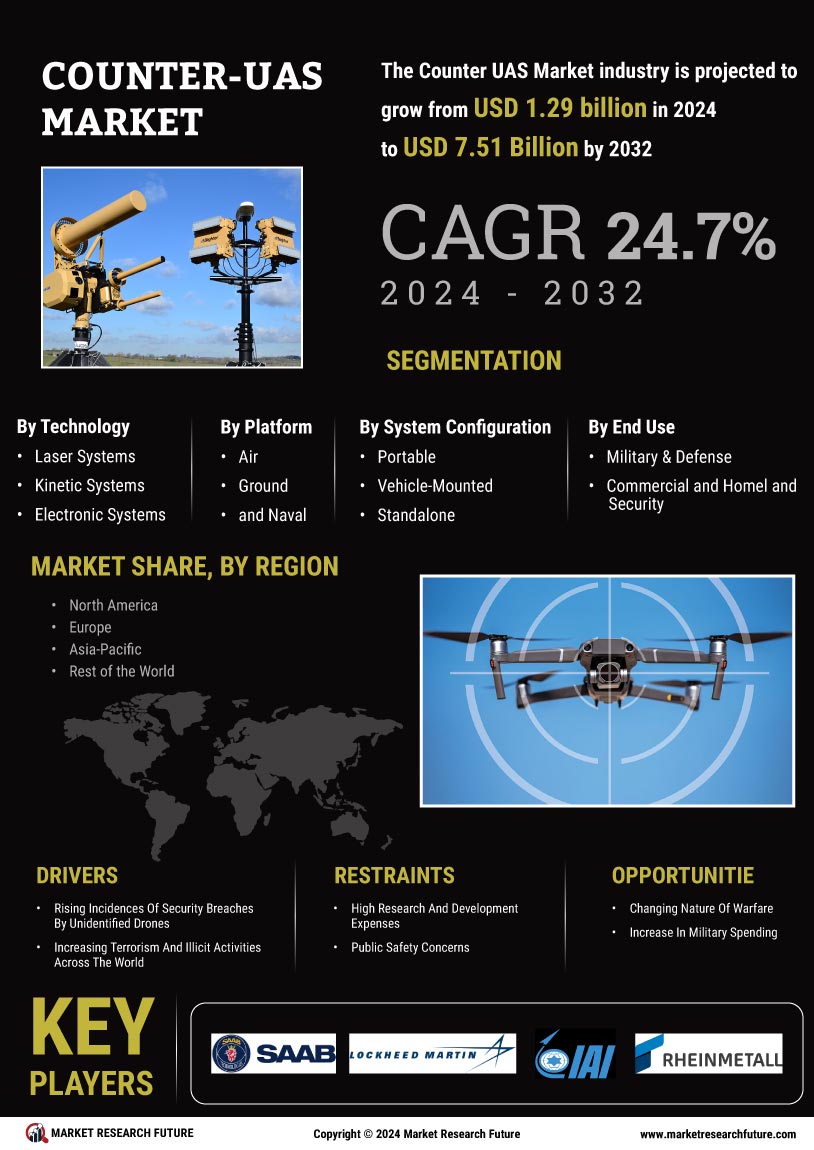

Market Growth Projections

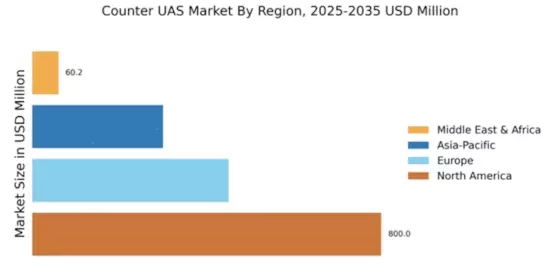

The Global Counter UAS Industry is poised for remarkable growth, with projections indicating a rise from 1.61 USD Billion in 2024 to an estimated 18.3 USD Billion by 2035. This trajectory suggests a robust CAGR of 24.72% from 2025 to 2035, reflecting the increasing demand for effective countermeasures against unauthorized drone activities. The growth is driven by various factors, including heightened security concerns, technological advancements, and regulatory developments. As stakeholders across sectors recognize the importance of safeguarding their operations, investments in counter UAS technologies are likely to surge, shaping the future landscape of the industry.

Technological Advancements

Rapid technological advancements in drone detection and neutralization systems are shaping the Global Counter UAS Industry. Innovations such as radar systems, radio frequency jamming, and laser-based solutions are becoming more sophisticated, enabling effective identification and interception of rogue drones. For example, the integration of artificial intelligence in detection systems enhances accuracy and response times. As these technologies evolve, they are expected to attract significant investments, contributing to the market's growth. With a projected CAGR of 24.72% from 2025 to 2035, the industry is likely to witness a surge in demand for advanced countermeasures that can keep pace with the evolving drone landscape.

Increasing Security Concerns

The Global Counter UAS Industry is driven by escalating security concerns across various sectors, including military, commercial, and critical infrastructure. Governments and organizations are increasingly aware of the potential threats posed by unauthorized drones, which can disrupt operations or compromise safety. For instance, incidents involving drones near airports have prompted regulatory bodies to enhance countermeasures. As a result, investments in counter-drone technologies are projected to rise significantly, with the market expected to reach 1.61 USD Billion in 2024. This heightened focus on security is likely to propel the industry forward, as stakeholders seek effective solutions to mitigate risks.

Military Modernization Efforts

Military modernization efforts globally are a crucial factor propelling the Global Counter UAS Industry. Armed forces are increasingly recognizing the need to counter the threats posed by drones, which can be used for reconnaissance, surveillance, or even attacks. As militaries invest in advanced counter-drone technologies, the market is expected to experience substantial growth. Countries are allocating budgets to develop and deploy sophisticated systems capable of neutralizing drone threats effectively. This focus on military capabilities is likely to drive innovation and investment in counter UAS solutions, contributing to the overall market expansion.

Rising Commercial Applications

The expansion of commercial applications for drones is a significant driver of the Global Counter UAS Industry. Industries such as logistics, agriculture, and surveillance are increasingly utilizing drones for various operations, which inadvertently raises concerns about unauthorized drone activities. As businesses adopt drone technology, the need for countermeasures to protect assets and ensure operational integrity becomes paramount. The market is projected to grow substantially, reaching 18.3 USD Billion by 2035, as companies seek to safeguard their operations against potential drone threats. This trend underscores the necessity for robust counter UAS solutions across diverse sectors.