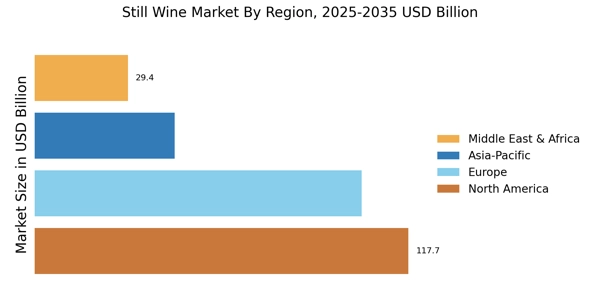

North America : Market Leader in Consumption

North America is the largest market for still wine, accounting for approximately 40% of global consumption. The region's growth is driven by increasing consumer interest in premium wines, health-conscious choices, and a growing number of wineries. Regulatory support, such as favorable taxation policies and trade agreements, further enhances market dynamics. The U.S. leads this market, followed by Canada, which holds around 10% of the market share. The competitive landscape in North America is robust, featuring key players like E. & J. Gallo Winery, Constellation Brands, and The Wine Group. These companies dominate the market with diverse product offerings and strong distribution networks. The presence of numerous local wineries also contributes to a vibrant market, catering to varying consumer preferences and enhancing competition among established brands.

Europe : Cultural Hub of Wine Production

Europe is a significant player in the still wine market, holding approximately 35% of the global share. The region's growth is fueled by a rich cultural heritage, increasing tourism, and a rising trend towards organic and sustainable wines. Countries like France and Italy are the largest markets, with France alone accounting for about 20% of the global market. Regulatory frameworks, such as the EU's Common Agricultural Policy, support local producers and promote quality standards. Leading countries in Europe include France, Italy, and Spain, each with a strong presence of renowned wineries. Key players like Pernod Ricard and Treasury Wine Estates are pivotal in shaping the competitive landscape. The market is characterized by a blend of traditional and modern winemaking techniques, catering to diverse consumer tastes and preferences. The European market remains dynamic, with ongoing innovations in wine production and marketing strategies.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region is rapidly emerging in the still wine market, currently holding about 15% of the global share. The growth is driven by increasing disposable incomes, changing consumer preferences towards wine over traditional spirits, and a burgeoning middle class. Countries like China and Australia are leading this trend, with China showing a significant increase in wine consumption, accounting for approximately 8% of the global market. Regulatory changes, including reduced tariffs on wine imports, are also facilitating market growth. Australia stands out as a key player in the region, with major companies like Treasury Wine Estates and Accolade Wines leading the market. The competitive landscape is evolving, with local wineries gaining traction alongside established international brands. The region's wine culture is developing, supported by wine education and tourism, which are further enhancing consumer engagement and market expansion.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is an emerging market for still wine, currently holding about 10% of the global share. The growth is primarily driven by increasing urbanization, a young population, and a gradual shift in consumer preferences towards wine. Countries like South Africa are leading the market, with a strong wine production tradition, while the UAE is witnessing a rise in wine consumption due to tourism and expatriate communities. Regulatory changes are also playing a role in promoting wine sales in certain areas. South Africa is the dominant player in the region, with a well-established wine industry and key players like Diageo and Accolade Wines making significant contributions. The competitive landscape is characterized by a mix of local and international brands, with increasing investments in marketing and distribution channels. The region presents untapped opportunities for growth, particularly in the premium wine segment, as consumer awareness and interest continue to rise.